|

Few years ago on a Saturday evening, I was shopping in the dairy section of this big retail store. While deciding which company’s milk to buy I noticed a kid nudging his mother to the foreign chocolates section and to his surprise his Mother was reluctant to budge as she was busy in choosing the size of the butter packet she needed to pick up.

The kid being frustrated by his mother not willing to move asked her,

‘Mother, why can’t you buy me that packet of 50 colorful chocolates?”

“I will buy you a lollipop from the billing counter when we bill our stuff, son”, his mother replied.

“But, I want that packet of chocolates. Those look very colorful. None of my friends probably have eaten such chocolates and I believe they will also enjoy them.”, the kid said with innocence.

“Son, I have to still buy a few things and we are running out of money, so I can’t buy you those chocolates as they are very expensive.”, the mother replied calmly to the kid’s groaning.

|

|

Clearly, in the era of credit cards this was a pretense which the mother came up with.

When the kid heard his mother’s reply, he jerked both his hands down in despair and told angrily to his mother

“I wish you had bought me a money printing machine instead of the GI JOE you bought me on my birthday. If I had a money printing machine I would have printed more and more money to buy things I always needed like this packet of chocolates”.

The mother chuckled at the innocence of the child and asked him, “and then when you are done buying all the things, what would you do then?”

The kid said, “I am going to distribute money among my friends so that they can also buy stuff they like”.

The mother was pleased at the innocence of the child because he was good enough to think about friends.

|

|

I couldn’t help but overhear the entire conversation. Soon both of them left but the kid gave me an important question to find an answer for.

As we have all heard that we have printing presses in the country so we have enough power to produce more money to make everyone rich but why don’t we do that.

And of course, there are numerous theories one of which is that every country needs to deposit gold in World Bank, depending on which it can have money in the country in that much amount which is true in case of few currencies.

|

So, why we simply can’t print more money?

We simply can’t print a lot of money because it is going to increase the supply of money more than it is demanded for.

The global economy as well as the economies of the countries depend on two factors supply and demand.

These two factors must always be in equilibrium with each other for the things to run smoothly.

If one of the things outperforms another then prices fluctuate and things start falling apart.

|

The Kid and The chocolates example

Suppose that the kid achieved his dream of printing money through a money printing machine. Now if earlier he used to have Rs 10 a day for consumption with this glorious money printing machine he now has Rs 100 a day for consumption.

With his compassionate attitude he printed more money and distributed it among his 9 other friends. Now all of his 9 friends have Rs 100 each for consumption on a single day.

This chain didn’t stop here as the friends of the kid have friends of themselves and so they keep distributing the money to their friends as well.

The kid kept printing money and eventually, one day came when around 10,000 kids had 100 Rs per day to spend.

Now, let’s assume the chocolate company coincidentally had all these 10,000 kids as its only clients. Earlier, before the glorious money printing machine, a kid could buy a packet for 10 Rs on one single day but as human desires are unlimited therefore, with more money in the pocket every kid is tempted to buy 9 more packets as he has Rs 100 now to spend.

Does the chocolate company think the same way?

The chocolate company is experiencing a sudden rise in demand of their chocolate packets and to feed the demand they will have to increase the supply.

This means that they have to buy more coco, more machines and equipment and to process coco, and enough man power to produce more chocolates and satisfy the demand of its 10,000 clients who have 100 Rs each to buy chocolates.

To bring in additional machinery and equipment, manpower and raw material the company will have to put more money in the business which means that its operational cost will increase.

Earlier, a packet of chocolate used to cost the company 5 Rs which would give the company 5 Rs operational profit, but now, with a sudden increase in demand and with its increasing operational costs, the company will be compelled to raise the prices.

|

|

So, let’s assume that now the company’s cost per packet increases to Rs 98 and in order to maintain its profit of 5 Rs, it has set the market price of 1 chocolate packet as Rs 103.

So, the next day when the kid will go to the market in the hope of buying 10 packets of chocolates, he will be surprised to find the fact that he can’t afford even a single packet of chocolates now.

When the kid is not able to afford even 1 packet of chocolates, this means that the purchasing power of the money he has is reduced and this phenomenon when the purchasing power of the money reduces is termed as ‘Inflation’.

Now, imagine this phenomenon spreading to all the chocolate companies in the country.

How will it impact those kids who still have Rs 10 per day to spend?

|

Hyperinflation

The incident described above is an example of hyperinflation when the prices rise by more than 50% in a small period of time probably in a time span of less than 2 months.

Usually, this type of inflation was witnessed around 80-85 years ago in a few countries like Germany where a whopping soreness in prices of general commodities, after the great depression, was encountered.

Controlling Inflation

The countries’ central banks like US Fed in the United States and RBI in India play a key role in controlling inflation.

Remember, that is why you read in the newspaper about RBI changing the interest rates or keeping them unchanged (well this will be covered in some other article in the future).

|

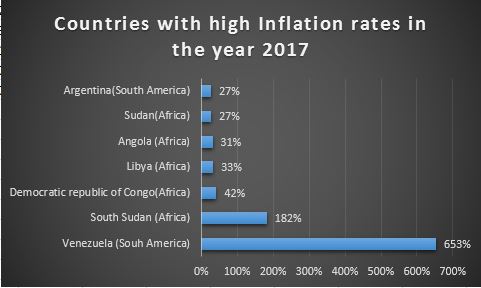

Countries with High Inflation

Usually, hyperinflation occurs due to big unpleasant events like the great depression, the recession period of 2008, due to mutiny or political unrest in the country.

It should be now clear for you to understand that the countries with high inflation have a very limited supply in answer to a high demand.

This limited supply is generally due to the corruption in the government or the whims of a few power hungry people who find pleasure in loading their bank account by controlling demand and supply.

Below picture tells you the countries which are going through a period of highest inflation –

Data of Countries with high inflation rates

Do we really need Inflation?

|

|

Almost everyone’s Grandma has told him/her at some point of time in life that too much money in too little time is bad for you and people around you.

Well, if we associate Grandma’s teaching with inflation then she was absolutely right.

And if you are thinking that there shouldn’t be any inflation in the country then you are not completely correct. The opposite of inflation is deflation which means that the purchasing power of money increases.

In relation to the above example it means that now the packet of chocolate which costs Rs 10 now will cost Rs 5 when deflation kicks in. This is really detrimental to the economy’s health as it can have a downward spiraling effect.

It leads to the mindset that “the prices are going down daily hence I will wait till the things I want to buy become cheaper”. This sentiment leads to decreasing demand and the supply looks huge in contrast. The deflation hurts companies and businesses because of the decreasing demand and so, in turn hurts economy.

Inflation in a contained amount is very necessary for a country. Why?

Because it means that the country’s economy is progressing.

So make sure that the money in your bank account is beating the inflation rate every year in order for you to progress with the economy of the country.

So, is there anything more you know that you want to add to this article?

Did you already know how printing more money that can’t keep up with the existing demand can hurt the economy?

|

|

Also Read

10 rarely known,amazing facts about India that will fill you with surprise and pride

6 Influential people of the world and books they read

How to study for long hours

Should students wear school uniforms?

To all students:how to deal with stressful situations particularly of exams

7 hobbies on resume to impress recruiters

5 Things you need to check during engineering

5 fears every student should be aware of for a better student life

|